ATM Deposits In Brazil

If you need to deposit money into a bank account in Brazil, you don’t have to do it during bank opening hours. In this article, we will learn how to deposit cash and cheques using ATMs in Brazil.

Concept

There are two ways of depositing money into a bank account in Brazil. You either go to the cashier in the bank or use one of the bank’s ATMs for self-service deposits. The concept is pretty simple and may save you a lot of time, since you do not need to queue for the cashier.

How to deposit money at ATMs

First of all, it is necessary to check if the bank operates ATM deposits. Although the banks which support this operation are becoming increasingly common, not all of them accept ATM deposits. Out of our list of the 10 major banks in Brazil, only Banco J Safra S/A and Banco PanAmericano S/A do not process ATM deposits.

It is worth mentioning that Brazilian ATMs can collect deposits in cash or cheques but not coins. Furthermore, each envelope must contain a maximum of 50 bills or 50 cheques. It is also important to state that the ATM does not give change.

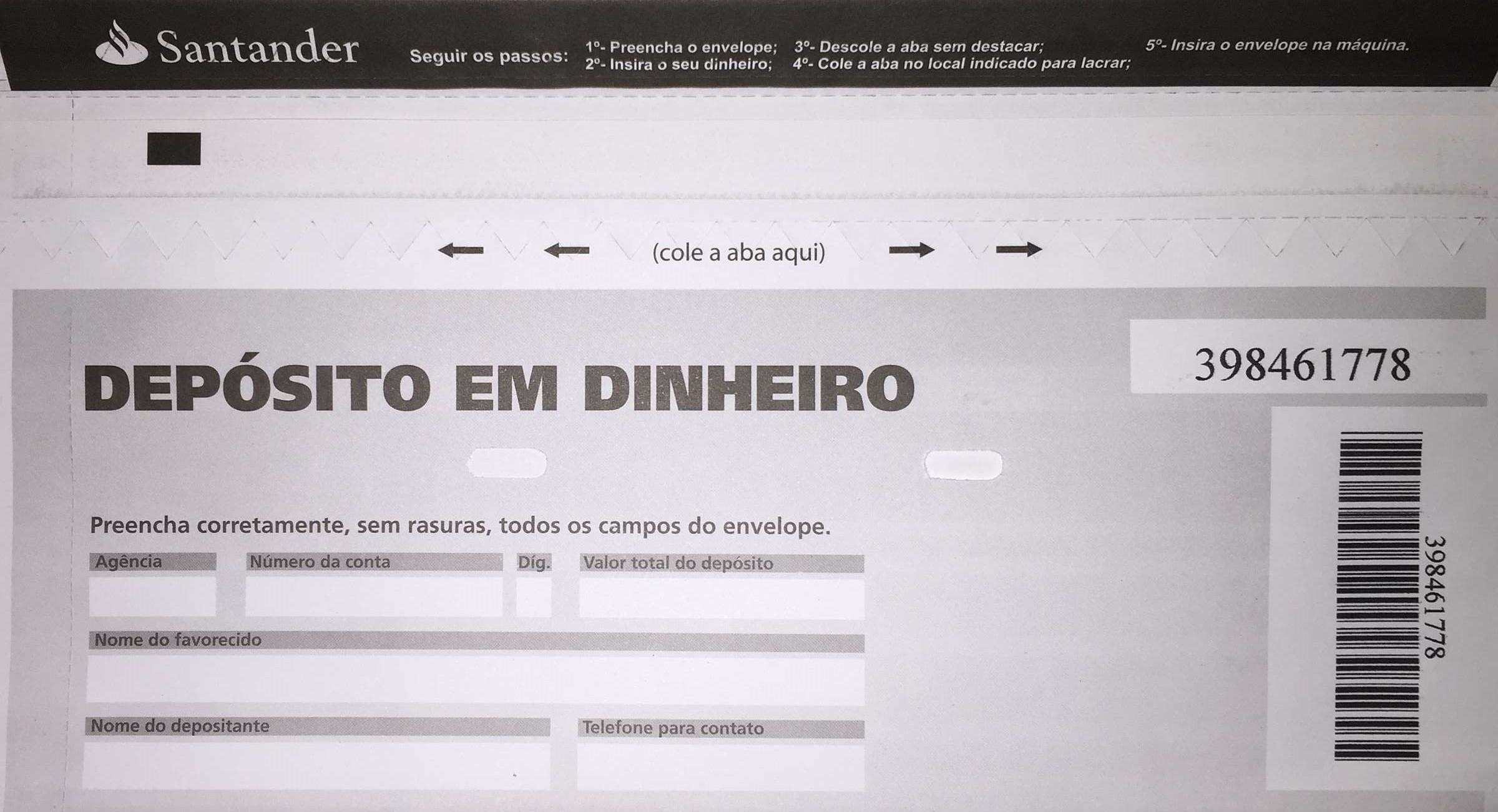

When depositing money in ATMs in Brazil it is necessary to use a special envelope which is easily found in the area close to the ATMs. Printed on the envelope you will find basic instructions on how to use it, such as:

- Maximum number of bills/cheques that can be put in a single envelope

- Maximum deposit per envelope, for cash and for cheques

- Time frame for when the money will be available in the beneficiary’s account

- The amount to be deposited must be the exact same amount that is inside the envelope

Although the design of the envelope may vary from bank to bank, the following information must be completed on the envelope:

- Nome do depositante - Name of the depositor

- Telefone para contato - Phone number

- Valor R$ - Amount to be deposited

- Conta Poupança ou Conta Corrente - Savings or checking account

- Nome do destinatário - Full name of the beneficiary

- Conta para depósito - Bank account number of the beneficiary

Here, we can see a deposit envelope:

Also, it is necessary to say that the deposit is only completed after a bank employee has manually confirmed the content of the envelope.

After completing the information on the envelope and placing the cash or cheque in it, the envelope must be sealed. While most envelopes already have an adhesive tape, some others must be glued by the depositor.

The next step is to proceed to the ATM and select the Depósito option on the screen, which is Portuguese for Deposit. The ATM will then ask you to confirm some of the information stated on the envelope and may even ask for additional information that was not previously specified on the envelope. When this is done, the ATM will ask you to insert the envelope in a designated opening.

Although the name of the depositor may be required on the envelope or at the ATM, it is important to remember that the depositor’s name will not be shown on the beneficiary’s bank statement. Should you want to identify the bank deposit, it is necessary to go to a cashier. Deposits with identification can be made using the CPF or CNPJ number.

It is important to mention that for ATM cash deposits the amount will be credited to the beneficiary’s account on the same day if the deposit is made during workdays before 4:00 PM. If the deposit is made during workdays between 4:00 PM and 10:00 AM, during the weekend or bank holidays the amount will only be credited to your account the next working day. For cheques it can take up to 48 hours, especially if the cheque is issued by a bank other than the beneficiary bank.

When the deposit is completed the ATM will issue a deposit slip. This operation is free of charge.

New ATMs

In June 2014, Bradesco bank released a new ATM that made it possible for people to make ATMs deposits without envelopes. With this innovation, the deposited amount is available in the beneficiary’s account instantly, since the new ATM is capable of counting money and spotting fake bills.