Channels

Resources

Events Venues

SEARCH INFO

There are 213 results for "branches of the policy" on The Brazil Business.

BEST MATCHES

In this article, we outlined the situation of the Brazilian market for European professionals looking for a relocation in the country. Check the areas that offer the best opportunities, the requirements to apply for the jobs and the salaries paid in here.

The IOF tax was created to replace the CPMF tax, abolished in 2008. In this article, you will know the basic information about this federal tax and its rates levied on credit, exchange, securities and insurance transactions.

This article will provide an introduction to Cofins, one of the contributions destined to finance the Brazilian Social Security system.

This article will provide an introduction on the main operations and responsibilities of the Central Bank of Brazil.

This article will outline the accounting audit procedures in Brazil. You will also get information about the rules and regulatory agencies that estabilish the guides on these activities, the techniques that are used, and which companies are obliged to hire these services in the country.

Foreigners who have to get in touch with the Brazilian government have probably found themselves in a difficult situation as they do not know to exactly they must contact. Learn in this article how you can get in touch with the Brazilian ministries that may be interesting for foreign investments.

Tobacco products have become more and more expensive in Brazil as taxation has reached levels that can be considered to be abusive. Learn in this article what are the taxes applying to tobacco products and why these products have become so expensive.

In order to have legal validity in Brazil, some documents may need to pass through a process of authentication in a Brazilian consulate abroad. In this article, you will get some general information about this process, when and where to do it, and in what cases foreigners are usually required to legalize documents issued abroad

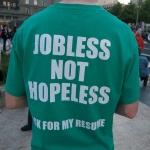

Brazilian employees are granted with several benefits: health insurance, meal, transportation and others. Apart from the benefits while they are working, Brazilians still receive some benefits for being unemployed – and for some people, they are even better than being employed.

Living as a regular middle class citizen in Brazil is so expensive that sometimes it is better to live among the poorest ones. This may sound nonsense to the ears of foreigners who are not familiar with the Brazilian popular culture, but there are some reasonable explanations for it.

Legal entities in Brazil are required to present the DIPJ to the Receita Federal, a statement containing their economic and tax information. Know in this article who exactly needs to fill up this form and what it should contain.

Those following the news about Brazil may think that we are living in a civil war. Such vision is reinforced in most Brazilian movies and even novels. But is Brazil a violent country? Compared to what? Is it really dangerous to live here?

Duty-free shops are very popular amongst Brazilians due to the protectionist policy adopted by the federal government that makes importing practices impracticable. Learn in this article what are the rules for bringing duty-free products into Brazil.

The 80’s were the beginning of a downfall for the Brazilian economic scenario. This crisis was extended to the new millennium with the crash of major companies like Varig and VASP. Find in this article a little bit of the history of these companies and what has led them to crash.

Living in Brazil is the dream of many foreigners, bur not all of them fulfill the requirements to apply for a residence visa. In this article, we will explain what are these requirements and give alternative advices to be able to stay legally in the country.