Channels

Resources

Events Venues

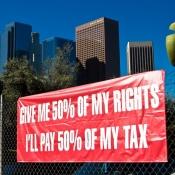

Every company dealing with Brazilian taxes agrees that the country urgently needs to reform its Taxation System. Over the last decade, several projects for reforms were made, but the changes adopted until now are far from meeting the taxpayers' needs.

Worldwide agreements regarding tax policies are crucial for a good business flow among countries. In this matter, Brazil seeks to expand its Double Tax Treaties as a way to avoid double taxation.

Living in Brazil means getting used to do a lot of calculations during the first months of the year. In this article we will get a closer look to three everyday taxes that are charged on assets.

STAY CONNECT WITH US

TOP ARTICLES

There are not many people that can truly say they completely understand the Brazilian Tax system, neither can we. This article will give you an outside-in view of Brazilian Tax incentives and policy.

Learn more about the Social Security in Brazil and the institution responsible for collecting the Instituto Nacional do Seguro Social contributions.

International companies are aware that Brazil has a huge IT market to be explored, but the current Taxation and Customs Law lack updates regarding software sales. Understand the contradictions about imports in this area.

This article will give you a brief explanation of the highest tax paid by companies in Brazil. Understand how the lion (Brazilian Revenue symbol) takes its bites and why you should never urge its rage.

Understanding the Brazilian legislation is already complicated by default, but when it comes to ISS, a municipal tax related to the act of providing services in Brazil, things can get even more complicated.

In Brazil, foreign entrepreneurs can catch themselves lost in the middle of many federal taxes, each one with a different acronym. PIS, COFINS, IPI, IRPJ are on the list, together with the CSLL, which we will clarify in this article.

Everybody knows that tax burden in Brazil is high and foreign businesses invest much time and resources in finding ways reduce taxes. This article will explain you why these taxes are so high.